Although a high DOL can be beneficial to the firm, often, firms with high DOL can be vulnerable to business cyclicality and changing macroeconomic conditions. For example, a company with a high DOL doesn’t have to increase spending to expand its sales volume with more business. The higher the DOL is, the more sensitive the company’s EBIT is to changes in sales. The degree of operating leverage calculator spreadsheet is available for download in Excel format by following the link below. This information shows that at the present level of operating sales (200 units), the change from this level has a DOL of 6 times. If sales and customer demand turned out lower than anticipated, a high DOL company could end up in financial ruin over the long run.

What Does the Degree of Operating Leverage Indicate?

The Degree of Operating Leverage (DOL) calculator helps you understand the proportionate change in operating income as a result of a change in sales. This is useful for analyzing the risk and potential return of investing in a business. Operating leverage is like having a financial magnifying glass—it amplifies the effects of sales changes on your profitability. By using an Operating Leverage Calculator, you gain valuable insights into how fixed and variable costs affect your bottom line.

Why You Can Trust Finance Strategists

In year one, the company’s operating expenses were $150,000, while in year two, the operating expenses were $175,000. The operating margin in the base case is 50%, as calculated earlier, and the benefits of high DOL can be seen in the upside case. Since 10mm units of the product were sold at a $25.00 per unit price, revenue comes out to $250mm.

Degree of Operating Leverage (DOL)

If you’re eager to understand how changes in sales impact your operating income, you’re in the right place. This guide will walk you through the ins and outs of using the Degree of Operating Leverage Calculator, all while keeping things engaging and lighthearted. Yes, DOL can be used to compare the operational risk of companies within the same industry, helping investors identify firms with higher or lower financial risk profiles.

How to Calculate Operating Leverage

- Under all three cases, the contribution margin remains constant at 90% because the variable costs increase (and decrease) based on the change in the units sold.

- The degree of operating leverage calculator is a tool that calculates a multiple that rates how much income can change as a consequence of a change in sales.

- In this best-case scenario of a company with a high DOL, earning outsized profits on each incremental sale becomes plausible, but this type of outcome is never guaranteed.

- Companies with a high degree of operating leverage (DOL) have a greater proportion of fixed costs that remain relatively unchanged under different production volumes.

- Now, we are ready to calculate the contribution margin, which is the $250mm in total revenue minus the $25mm in variable costs.

- Therefore, each marginal unit is sold at a lesser cost, creating the potential for greater profitability since fixed costs such as rent and utilities remain the same regardless of output.

The higher the degree of operating leverage, the greater the potential danger from forecasting risk, in which a relatively small error in forecasting sales can be magnified into large errors in cash flow projections. In addition, in this scenario, the selling price per unit is set to $50.00, and the cost per unit is $20.00, which comes out to a contribution margin of $300mm in the base case (and 60% margin). However, the downside case is where we can see the negative side of high DOL, as the operating margin fell from 50% to 10% due to the decrease in units sold. If revenue increased, the benefit to operating margin would be greater, but if it were to decrease, the margins of the company could potentially face significant downward pressure. This section will use the financial data from a real company and put it into our degree of operating leverage calculator.

These calculators are important because as critical as it is to know how the business is doing, the price you are paying for a part of the company is also important. DOL is based on historical data and may not accurately predict future performance. Additionally, it does not consider the impact of external factors like market conditions and economic changes. The DOL calculator is one of many financial calculators used in bookkeeping and accounting, discover another at the links below. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

The higher the DOL, the more a company’s operating income will be affected by changes in sales. If a company has low operating leverage (i.e., greater variable costs), each additional dollar of revenue can potentially generate less profit as costs increase in proportion to the increased revenue. The reason operating leverage is an essential metric to track is because the relationship between fixed and variable costs can significantly influence a company’s scalability and profitability. To lower your DOL, consider reducing fixed costs, increasing variable costs, or adjusting your cost structure to make it more flexible in response to sales changes. John’s Software is a leading software business, which mostly incurs fixed costs for upfront development and marketing. John’s fixed costs are $780,000, which goes towards developers’ salaries and the cost per unit is $0.08.

But this comes out to only a $9mm increase in variable costs whereas revenue grew by $93mm ($200mm to $293mm) in the same time frame. If all goes as planned, the initial investment will be earned back eventually, and what remains is a high-margin company with recurring revenue. In this best-case scenario of a company with a high DOL, earning outsized profits on each incremental sale becomes plausible, but this type of outcome is never guaranteed. If a company has high operating leverage, each additional dollar of revenue can potentially be brought in at higher profits after the break-even point has been exceeded. At the end of the day, operating leverage can tell managers, investors, creditors, and analysts how risky a company may be.

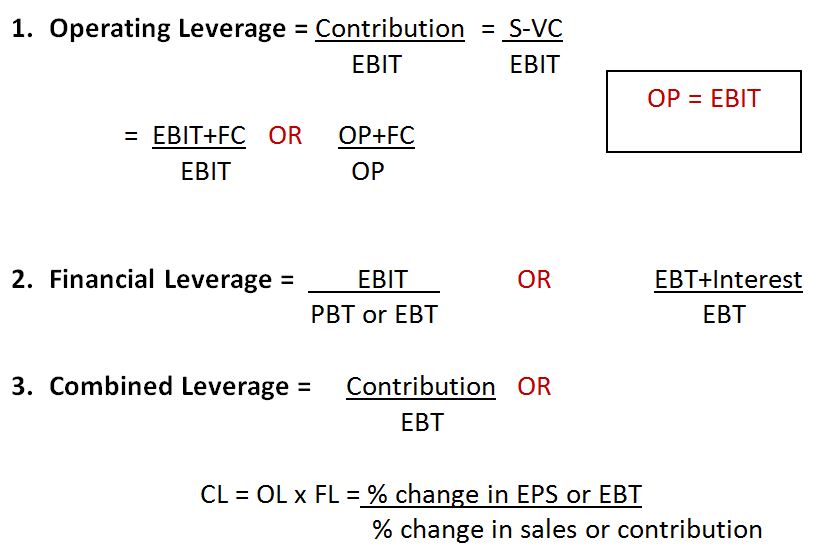

Financial and operating leverage are two of the most critical leverages for a business. Besides, they are related because earnings from operations can be boosted by financing; meanwhile, debt will eventually be paid back by those increased earnings. On the contrary, companies having low operating leverage iowa capital gain deduction flowchart may find it effortless to earn a profit when trading with lower sales. A company with a high DOL can see huge changes in profits with a relatively smaller change in sales. A lower DOL indicates that your profits are less sensitive to sales changes, allowing for more flexibility in pricing and promotions.

It emerged as an essential tool for analyzing how fixed and variable costs impact a company’s profitability. For example, a software business has greater fixed costs in developers’ salaries and lower variable costs in software sales. In contrast, a computer consulting firm charges its clients hourly and doesn’t need expensive office space because its consultants work in clients’ offices. It is important to understand that controlling fixed costs can lead to a higher DOL because they are independent of sales volume. The percentage change in profits as a result of changes in the sales volume is higher than the percentage change in sales.