Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Key Takeaways

But the concept of outstanding shares is a bit more complicated than it seems. The number of shares outstanding changes over time, sometimes dramatically, which can impact the calculation for a reporting period. At any given point, instruments like warrants and stock options must be accounted for as well. Conversely, outstanding stocks will decrease if a firm completes a share buyback or a reverse stock split (consolidating a corporation’s shares according to a predetermined ratio).

How to Calculate Outstanding shares?

Companies typically issue shares when they raise capital through equity financing or when they exercise employee stock options (ESOs) or other financial instruments. Outstanding shares decrease if the company buys back its shares under a share repurchase program. Weighted average shares outstanding is the number of company shares after incorporating changes in the shares during the year. The number of company shares can vary during the year for various reasons. E.g., buyback of shares, the new issue of shares, share dividend, stock split, conversion of warrants, etc.

Do you own a business?

Common shareholders have voting rights to elect the Board of Directors and pass (or reject) corporate policies brought to vote by shareowners. normal balance Most individuals with enough idle cash to invest are hesitant since they are unsure which company to invest in. “Shares outstanding” also is a line in the data that is displayed with any stock quote.

Issued Vs. Outstanding Vs. Authorized

Stock splits are usually undertaken to bring the shares outstanding formula share price of a company within the buying range of retail investors; the increase in the number of outstanding shares also improves liquidity. So far, we’ve focused on shares outstanding, whether basic or diluted, at a fixed point in time. In SEC filings, companies will report the total number of shares outstanding on a given day, but in their quarterly and annual figures they must also offer the weighted average shares outstanding. Outstanding shares are those owned by stockholders, company officials, and investors in the public domain, including retail investors, institutional investors, and insiders. From the previous example, we know that this company has 1,000 authorized shares. If it offered 300 shares in an IPO, gave 150 to the executives, and retained 550 in the treasury, then the number of shares outstanding would be 450 shares (300 float shares + 150 restricted shares).

Diluted Earnings Per Share

- A significant change in outstanding shares, such as through a stock buyback or issuance, can signal strategic shifts and impact investor sentiment.

- Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

- The outstanding shares figure is useful to know for an investor that is contemplating buying shares in a company.

- Contrary to this, the stock with a much lower number of outstanding stocks could be more vulnerable to price manipulation, requiring much fewer shares to be traded up or down to move the stock price.

- Because they are generally entitled to a certain dividend and are reimbursed in the event of a company’s collapse, preferred stockholders have less risk than common stockholders.

The profit and loss statements in nearly every corporate earnings press release will include both basic and diluted shares outstanding. A company’s outstanding shares, the total shares held by shareholders excluding treasury stock, can fluctuate due to various factors. Notably, stock splits and reverse stock splits significantly influence the number of outstanding shares. Outstanding shares provide insights into a company’s size, ownership structure, and market capitalization.

- The number of shares outstanding can also be reduced via a reverse stock split.

- Diluted EPS is usually lower than basic EPS because it takes into account the potential dilution of earnings that could occur if all dilutive securities were exercised.

- Preferred shares are classified into cumulative preferred, non-cumulative, participating preferred, and convertible preferred stocks.

- As noted above, outstanding shares are used to determine very important financial metrics for public companies.

- Preferred shares, as the name implies, give preference to preferred shareholders and pay them dividends before common ones.

- The weighted average is a significant number because companies use it to calculate key financial measures with greater accuracy, such as earnings per share (EPS) for the time period.

Often, this type of stock is given to insiders as part of their salaries or as additional benefits. This refers to a company’s shares that are freely bought and sold without restrictions by the public. Denoting the greatest proportion of stocks trading on the exchanges, the float consists of regular shares that many of us will hear or read about in the news. The number of outstanding shares is calculated by subtracting treasury stock from the shares issued. Generally, you won’t need to calculate this number yourself and it will be listed for you on a company’s 10-Q or 10-K filing.

Weighted Average Shares Outstanding

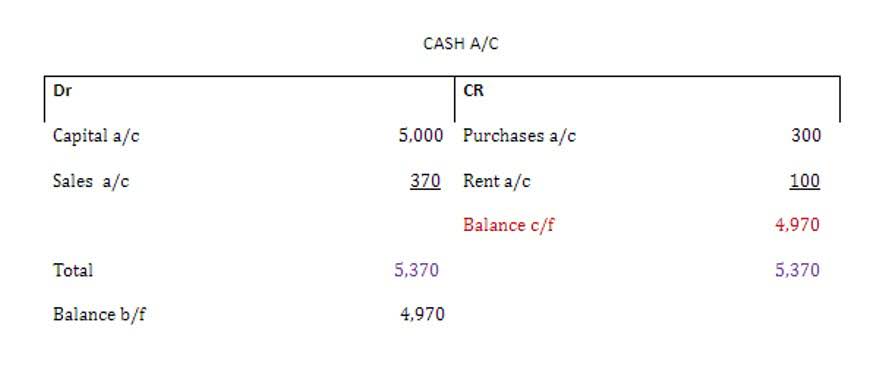

Thus, while calculating Earnings per Share, the https://x.com/bookstimeinc Company needs to find the weighted average number of shares outstanding. It incorporates all such scenarios of changes in the weighted average number of shares to give fair Earnings per share value. A number of company activities can change its number of shares outstanding.

What is the difference between basic and diluted EPS?

If a shareholder is not paid on time, preferred shares allow for that person to still receive their full dividend payment, including any missed or previous payments. This implies that before common shareholders can claim the assets in a company, bondholders, preferred shareholders, employees, and creditors must be repaid completely. To calculate the weighted average cost per share, the investor can multiply the number of shares acquired at each price by that price, add those values, and then divide the total value by the total number of shares. It includes shares held by the general public and restricted shares that are owned by company officers and insiders.